Internal Growth Rate of a Firm Is Best Described as

If the firm also wishes to maintain a constant debt-equity ratio what must it be. Minimum growth rate achievable if the firm maintains a constant equity multiplier b.

Sustainable Growth Rate Definition Example How To Calculate

The sustainable growth rate of a firm is best described as the.

. Minimum growth rate achievable if the firm maintains a constant equity multiplier. Maximum growth rate achievable excluding external financing of any kind. Determine the estimated market price of the equity share if the anticipated growth rate of the firm rises.

The ratio of total assets to sales is constant at 1 and the profit margin is 81 percent. Excluding external financing of any kind. The internal growth rate of a firm is best described as the.

A firm wishes to maintain an internal growth rate of 9 percent and a dividend payout ratio of 66 percent. The modified internal rate of return MIRR assumes that positive cash flows are reinvested at the firms cost of capital and that the initial outlays are financed at the firms financing cost. This can for example be done by assessing a companys core competencies and by determining and exploiting the strenght of its current resources with the aid of the VRIO framework.

If the firm maintains a constant equity multiplier. Maximum growth rate achievable excluding any external equity financing while. B The minimum growth rate achievable if the firm maintains a constant equity multiplier.

31 The internal growth rate of a firm is best described as the ________ growth rate achievable ________. D g Growth Rate Answer. Maximum growth rate achievable excluding external financing of any kind.

Cmaximum growth rate achievable excluding external financing of any kind. Internal growth is achieved using only retained earnings not paid out as dividends to invest in new assets. 3 on a question.

The current profit margin is 7 percent and the firm uses no external financing sources. Maximum growth rate achievable excluding any external equity financing while. Aminimum growth rate achievable assuming a 100 percent retention ratio.

Minimum growth rate achievable assuming a 100 percent retention ratio d. The sustainable growth rate of a firm is best described as the _____ growth rate achievable _____. Return on equity 01949 010 11 1 DE.

The internal growth rate of a firm is best described as the. The internal growth rate of a firm is best described as the. Terms in this set 37 Internal Growth Rate.

The maximum growth rate a firm can achieve without external equity financing while maintaining a constant debt-equity ratio. Maximum growth rate achievable with unlimited. Minimum growth rate achievable if the firm maintains a constant equity multiplier.

Excluding external financing of any kind. Dmaximum growth rate achievable excluding any external equity. Maximum growth rate achievable excluding any external equity financing while.

Its essentially the growth that a firm can supply by reinvesting its earnings. Maximum growth rate achievable excluding external. Internal Rate of Return is widely used in analyzing investments for private equity and venture capital which involves multiple cash investments over the life of a business and a cash flow at the end through an IPO or sale of the business Sale and Purchase Agreement The Sale and Purchase Agreement SPA represents the outcome of key commercial.

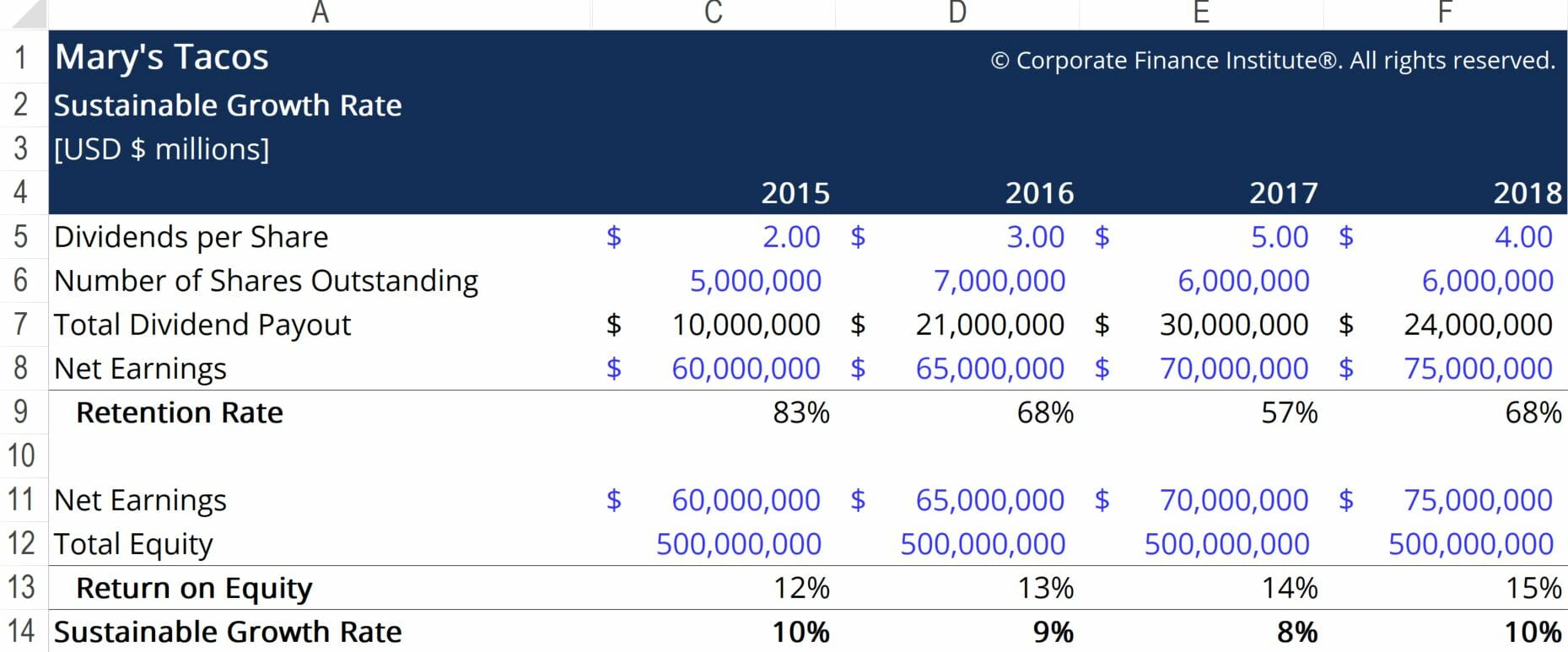

Minimum growth rate achievable if the firm maintains a constant equity multiplier. Often referred to as G the sustainable growth rate can be calculated by multiplying a companys earnings retention rate by its return on equity Return on Equity ROE Return on Equity ROE is a measure of a companys profitability that takes a companys annual return net income divided by the value of its total shareholders equity. Since no capital is needed from outside investors it is referred to as the internal growth rate.

D g Growth Rate Question 101. The estimated growth of the company is approximately 5 per year. The internal growth rate is a formula for calculating maximum growth rate that a firm can achieve without resorting to external financing.

A The minimum growth rate achievable if the firm does not pay out any cash dividends. Maximum growth rate achievable excluding external financing of any kind c. Minimum growth rate achievable assuming a 100 percent retention ratio.

The maximum growth rate a firm can achieve without external financing of any kind. The internal growth rate of a firm is best described. 18- The internal growth rate of a firm is best described as.

If the firm maintains a constant equity multiplier. The internal growth rate of a firm is best described as the. With unlimited debt financing.

The firm had paid dividend 45 per share last year. Internal growth or organic growth is when a business expands its own operations by relying on developing its own internal resources and capabilities. A firm wishes to maintain an internal growth rate of 11 percent and a dividend payout ratio of 24 percent.

Bminimum growth rate achievable if the firm maintains a constant equity multiplier. The growth rate can be calculated on a historical. The shares of company are selling at 45 per share.

The internal growth rate of a firm is best described as the. Minimum growth rate achievable assuming a 100 percent retention ratio. Maximum growth rate achievable excluding external financing of any kind.

Minimum growth rate achievable assuming a 100 percent retention ratio. Assuming a 100 percent retention ratio. The internal growth rate of a firm is best described as.

B The minimum growth rate achievable if the firm maintains a constant equity multiplier. An internal growth rate IGR is the highest level of growth achievable for a business without obtaining outside financing and a firms maximum internal growth rate is the level of business. Internal Growth Rate IGR A companys internal growth rate is the growth that can be achieved without issuing additional equity or debt financing.

Assuming a retention ratio of 100 percent. Minimum growth rate achievable if the firm maintains a constant equity multiplier. Minimum growth rate achievable assuming a 100 percent retention ratio.

A The minimum growth rate achievable if the firm does not pay out any cash dividends.

Infographic Here Is The Data On Data Center Energy Data Center Data Center Infrastructure Data

Accelerate Digital Transformation With Forrester S Business Innovation Canvas Digital Transformation Business Innovation Change Management

Growth Strategy Powerpoint Growth Strategy Strategy Tools Marketing Insights

Compound Annual Growth Rate Cagr Formula And Excel Calculator

56 Strategic Objective Examples For Your Company To Copy Clearpoint Strategy Business Marketing Plan Business Finance Management Strategic Leadership

Ev Sales Ratio In 2022 Enterprise Value Financial Ratio Financial Modeling

Report Template Executive Summary 6 Templates Example Executive Summary Template Executive Summary Book Report Templates

Executive Assistant Resume Examples Guide For 2020 Administrative Assistant Resume Executive Assistant Executive Assistant Jobs

Setting Up A Balanced Scorecard Bsc For Managing Your Firm S Performance Social Media Resources Business Strategy Management Social Media Trends

Data Center Startup From Singapore Acquires Indonet For Idr 2 36 Trillion Start Up Data Center Singapore

/business-team-present--photo-professional-investor-working-new-startup-business-project--finance-business-meeting--digital-tablet-laptop-computer-smart-phone-using--824778670-5ae0c50fae9ab8003740e811-1c6be08fcf9d475599065be7ef43d0d4.jpg)

The Definition Of Internal Growth Rate Igr

Air Mail Par Avion Rubber Stamp Engineer Seal Stamps In 2022 Rubber Stamps Seal Stamps Air Mail

10 Saas Marketing Strategies For Businesses Saas Marketing Strategy Strategies

Sustainable Growth Rate Definition Example How To Calculate

Sustainable Growth Rate Sgr Deeper Understanding And Interpretation Of Sgr In 2022 Understanding Interpretation Growth

Sustainable Growth Rate Sgr Definition

Which Internal And External Factors Are Affecting The Recruitment Process In Hrm Recruitment Career Planning Factors